Max Resource Reports High-Grade Assays from the Florália Hematite DSO Project in Minas Gerais, Brazil

Vancouver B.C., March 30, 2025 – MAX RESOURCE CORP. (“Max” or the “Company”) (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) is pleased to report an update on the Florália Hematite DSO Project (“Florália DSO”) located 67 km east of Belo Horizonte, Minas Gerais, Brazil’s largest iron ore and steel producing State.

Max has received high-grade assay results. To date, a total of 174 channel samples were taken across banded iron formation (BIF), with 131 returning values from 50 to 61% Fe with highlight value of 64.7% Fe (19mm fraction). Phosphorus values were low ranging from 0.01% to 0.05% (refer to Table 2, 3 & Figure 1).

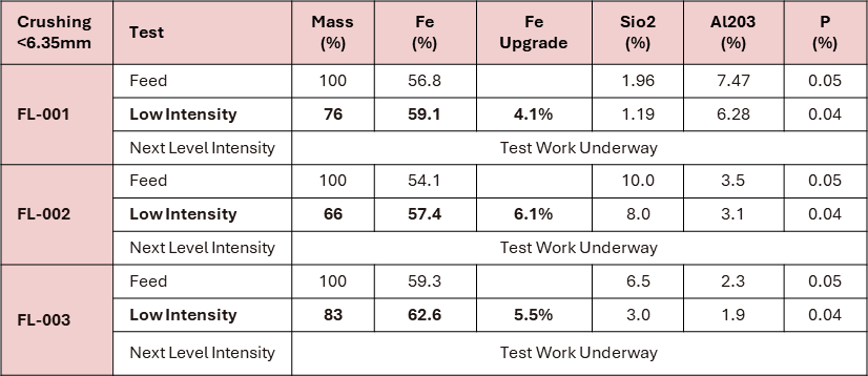

In addition, dry magnetic tests of 3 bulk (200 kg) samples, coarse crushed (<6.35mm), with a single pass, in a simple low magnetic drum circuit successfully increased Fe values from 4 to >6%. Typical next level magnetic intensity test work underway with the objective of further increasing Fe values (refer to Table below & Figure 3).

200 kg samples were collected and delivered to Fundação Gorceix é uma Instituição, Ouro Preto, Minas Gerais, Brazil for dry magnetic test work.

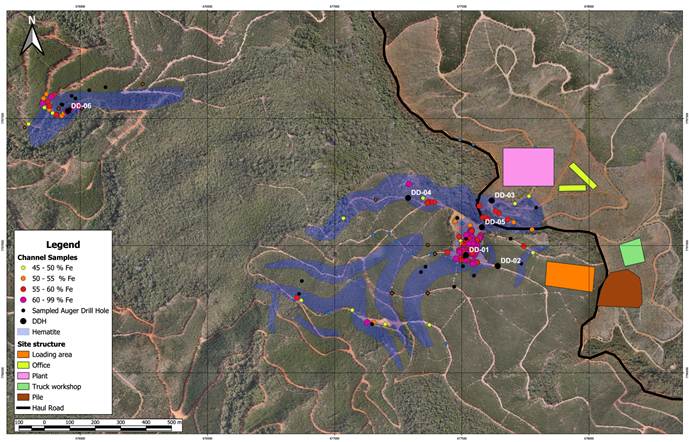

We are pleased to report the inaugural 2025 drilling program consisting of approximately 800m of auger and 800m of diamond drilling nears completion. Preliminary results are due shortly (refer to Figure 2 and 3).

Max’s inaugural 2024 exploration program resulted in the technical team significantly increasing the Florália DSO geological target from 8-12mt at 58% Fe to 50 to 70mt at 55%-61% Fe.

Max cautions investors the potential quantity and grade of the iron ore is conceptual in nature, and further cautions there has been insufficient exploration to define a mineral resource and Max is uncertain if further exploration will result in the target being delineated as a mineral resource. Hematite mineralization tonnage potential estimation is based on in situ high-grade outcrops and interpreted and modelled magnetic anomalies. Density value used for the estimate is 2.8t/m³. Hematite sample grades range between 55-61%Fe. The 58 channel samples were collected for chemical analysis from in situ outcrops in previously mined slopes of industrial materials.

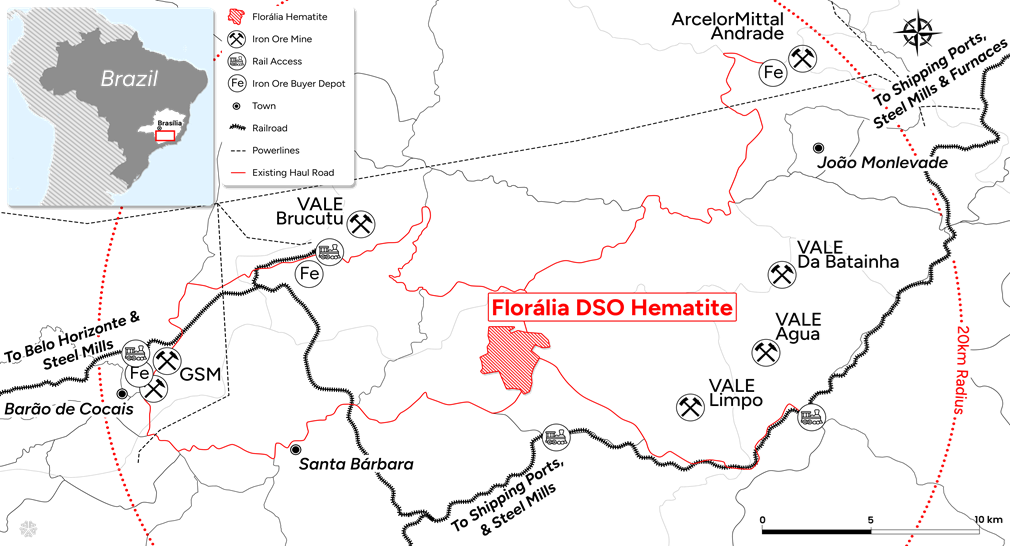

The Florália DSO Project holds advantages over other DSO (Direct Shipping Ore) projects in the Minas Gerais region: as strategically connected to an existing 20 km road southeast to rail loading terminal with rail networks connecting to multiple steel mills and shipping ports. Additionally, Florália DSO is connected via existing roads to potential DSO buyers, including Vale 20 km northwest and Arcelor Mittal 30 km east (refer to Figure 1).

“The channel assay results confirm the presence of high-grade iron ore (DSO) at Florália, with increased Fe grades through a dry magnetic circuit. Based on success, Florália could potentially supply superior DSO for local, domestic and overseas buyers,” Max CEO commented.

“In addition, Max Iron Brazil has received In-Principle Advice from the ASX, in regards to a planned listing on the official ASX list, to then secure funding for the next stage of exploration and development for the Floralia DSO Project,” he concluded.

Figure 1: Florália location and infrastructure map

Florália DSO, connected to existing 20 km road SE to railway terminal: existing roads to potential DSO buyers Vale (20 km NW) & Arcelor Mittal (30 km E) refer to map above. Local mining infrastructure; railway networks, haul roads, mining services & personnel.

Figure 2: Florália geochemistry, logistics & drill hole locations

Florália channel geochemistry, logistics, auger and diamond drill hole locations

Figure 3: Florália DSO historic open cut; diamond drill hole DH-001 and drill core

Dry magnetic bulk (200 kg) sample locations FL-001, FL-002 and FL-003

Table 1: Florália BIF results by Max (2024-2025) and Jaguar (2023)

Channel Sample # | Global Fe (%) | Fraction (mm) Fe (%) |

| Channel Sample # | Global Fe (%) |

FC-001 | 57.6 | 63.8 (<0.15) |

| JGC-001 | 58.2 |

FC-002 | 54.9 | 57.4 (22) |

| JGC-002-1 | 58.3 |

FC-003 | 58.3 | 63.2 (<0.15) |

| JGC-002-2 | 61.0 |

FC-004 | 52.3 | 57.0(<0.15) |

| JGC-003-1 | 52.0 |

FC-005 | 57.4 | 64.0 (1) |

| JGC-003-2 | 58.8 |

FC-006 | 58.3 | 61.3 (<0.15) |

| JGC-004-1 | 55.4 |

FC-007 | 56.6 | 60.8 (16) |

| JGC-004-2 | 58.5 |

FC-008 | 53.7 | 61.4 (<0.15) |

| JGC-005-1 | 57.4 |

FC-009 | 58.9 | 62.3 (<0.15) |

| JGC-005-2 | 60.2 |

FC-010 | 58.1 | 61.5 (0.15) |

| JGC-006-1 | 55.9 |

FC-012 | 55.2 | 62.7 (<0.15) |

| JGC-007-1 | 61.9 |

FC-013 | 52.2 | 55.0 (16) |

| JGC-007-2 | 58.0 |

FC-015 | 51.1 |

|

| JGC-008-1 | 58.4 |

FC-016 | 54.5 |

|

| JGC-008-2 | 58.2 |

FC-017 | 58.1 | 62.9 (19) |

| JGC-009-1 | 56.6 |

FC-018 | 56.3 |

|

| JGC-009-2 | 56.1 |

FC-019 | 58.7 | 61.9 (22) |

| JGC-010 | 53.2 |

FC-021 | 52.8 | 55.3 (1) |

| JGC-011-1 | 58.5 |

FC-022 | 56.8 | 59.9 (<0.15) |

| JGC-011-2 | 61.5 |

FC-023 | 52.6 |

|

| JGC-012 | 59.6 |

FC-024 | 59.8 | 62.6 (1) |

| JGC-013 | 58.8 |

FC-025 | 55.8 |

|

| JGC-014-1 | 57.8 |

FC-026 | 55.7 |

|

| JGC-014-2 | 59.3 |

FC-027 | 56.0 |

|

| JGC-015-1 | 60.9 |

FC-029 | 51.4 | 54.4 (1) |

| JGC-015-2 | 61.4 |

FC-030 | 56.4 | 59.7 (0.15) |

| JGC-016 | 63.7 |

FC-031 | 56.4 | 62.6 (19) |

| JGC-017 | 54.5 |

FC-032 | 53.6 |

|

| JGC-018 | 61.5 |

FC-033 | 56.0 |

|

| JGC-019 | 60.2 |

FC-034 | 53.1 |

|

| JGC-020 | 58.2 |

FC-035 | 52.2 | 56.3 (1) |

| JGC-021 | 58.6 |

FC-036 | 53.7 |

|

| JGC-022-1 | 61.1 |

FC-037 | 56.0 | 62.0 (0.15) |

| JGC-022-2 | 61.1 |

FC-039 | 60.3 | 62.4 (1) |

| JGC-022-3 | 57.5 |

FC-040 | 56.4 |

|

| JGC-023 | 58.8 |

FC-041 | 54.8 | 62.1 (1) |

| JGC-024 | 57.7 |

FC-042 | 56.7 |

|

| JGC-025 | 60.6 |

FC-043 | 61.0 | 64.9 (1) |

| JGC-026-1 | 56.0 |

FC-044 | 51.9 |

|

| JGC-026-2 | 54.4 |

FC-045 | 56.3 |

|

| JGC-026-3 | 52.5 |

FC-046 | 52.9 | 63.6 (19) |

| JGC-027 | 58.2 |

FC-047 | 56.2 |

|

| JGC-028 | 58.6 |

FC-048 | 57.6 | 59.1 (1) |

| JGC-029 | 55.0 |

FC-049 | 58.4 |

|

| JGC-030 | 58.0 |

FC-050 | 55.1 |

|

| JGC-031 | 56.5 |

FC-051 | 55.0 | 58.8 (1) |

| JGC-031-1 | 56.8 |

FC-052 | 54.0 |

|

| JGC-032-2 | 58.2 |

FC-053 | 56.8 |

|

| JGC-033 | 56.7 |

FC-054 | 54.1 | 59.6 (6.3) |

| JGC-034 | 56.9 |

FC-055 | 56.3 |

|

| JGC-035 | 59.3 |

FC-056 | 55.0 |

|

| JGC-036-1 | 58.5 |

FC-057 | 58.3 |

|

| JGC-036-2 | 58.8 |

FC-058 | 60.5 | 62.8 (0.15) |

| JGC-037 | 57.3 |

FC-059 | 59.7 |

|

| JGC-038 | 54.7 |

FC-061 | 51.1 | 58.1 (19) |

| JGC-039 | 57.9 |

FC-063 | 52.2 | 56.6 (19) |

| JGC-040 | 61.4 |

FC-064 | 55.1 | 58.1 (19) |

| JGC-041 | 54.8 |

FC-065 | 52.0 | 55.4 (16) |

|

|

|

FC-071 | 51.6 | 53.9 (19) |

|

|

|

FC-074 | 53.7 | 54.6 (19) |

|

|

|

FC-075 | 56.7 | 59.6 (<0.15) |

|

|

|

FC-077 | 56.8 | 58.3 (<0.15) |

|

|

|

FC-094 | 53.9 | 58.0 (19) |

|

|

|

FC-122 | 50.9 | 59.5 (19) |

|

|

|

FC-123 | 51.2 | 56.5 (19) |

|

|

|

FC-131 | 51.6 | 57.8 (19) |

|

|

|

FC-146 | 59.8 | 65.8 (<0.15) |

|

|

|

FC-151 | 54.5 | 60.0 (6.3) |

|

|

|

FC-159 | 56.1 | 63.6 (16) |

|

|

|

FC-160 | 51.6 | 61.6 (16) |

|

|

|

FC-161 | 52.1 | 57.9 (16) |

|

|

|

FC-162 | 58.2 | 64.7 (19) |

|

|

|

FC-169 | 52.1 | 59.5 (19) |

|

|

|

FC-170 | 53.1 | 57.2 (19) |

|

|

|

Table 2: Florália BIF fraction results by Max (2024-2025)

Channel Sample # | Global Fe (%) | 22mm Fe (%) | 19mm Fe (%) | 16mm Fe (%) | 6.3mm Fe (%) | 1mm (Fe%) | 0.15mm Fe (%) | Fe (%) <0.15mm |

FC-001 | 57.6 | 44.9 | 42.0 | 44.0 | 51.9 | 56.9 | 59.2 | 63.8 |

FC-002 | 54.9 | 57.4 | 57.3 | 54.7 | 56.5 | 56.0 | 47.6 | 57.3 |

FC-003 | 58.3 | 59.9 | 58.1 | 59.1 | 58.2 | 57.1 | 54.5 | 63.2 |

FC-004 | 52.3 | 52.3 | 52.5 | 52.1 | 53.3 | 53.1 | 47.8 | 57.0 |

FC-005 | 57.4 | 63.5 | 62.1 | 63.2 | 63.3 | 64.0 | 45.8 | 50.4 |

FC-006 | 58.3 | 59.4 | 60.5 | 60.0 | 58.8 | 61.2 | 51.8 | 61.3 |

FC-007 | 56.6 | 60.0 | 60.7 | 60.8 | 57.6 | 56.1 | 49.4 | 60.5 |

FC-008 | 53.7 | 57.7 | 55.8 | 55.6 | 55.4 | 53.1 | 46.2 | 61.4 |

FC-009 | 58.9 | 60.5 | 57.9 | 58.2 | 59.4 | 59.8 | 53.8 | 62.3 |

FC-010 | 58.1 | 53.5 | 51.9 | 53.7 | 53.7 | 56.3 | 61.5 | 60.3 |

FC-012 | 55.2 | 57.0 | 56.2 | 56.9 | 56.5 | 54.2 | 48.0 | 62.7 |

FC-013 | 52.2 | 53.2 | 54.6 | 55.0 | 53.8 | 52.2 | 47.7 | 51.7 |

FC-017 | 58.1 | 58.2 | 62.8 | 58.7 | 61.2 | 60.0 | 55.4 | 58.7 |

FC-019 | 58.7 | 61.9 | 59.9 | 58.7 | 60.6 | 61.0 | 54.6 | 59.7 |

FC-021 | 52.8 | 49.1 | 51.0 | 50.9 | 54.3 | 55.3 | 52.3 | 50.8 |

FC-022 | 56.8 | 48.7 | 49.0 | 45.9 | 50.4 | 56.9 | 59.6 | 59.9 |

FC-024 | 59.8 | 51.5 | 59.2 | 54.5 | 60.5 | 62.6 | 59.7 | 59.0 |

FC-029 | 51.4 | 51.7 | 52.6 | 51.0 | 53.9 | 54.4 | 49.5 | 48.0 |

FC-030 | 56.4 | 48.3 | 44.0 | 50.8 | 55.2 | 58.1 | 59.7 | 58.0 |

FC-031 | 56.4 | 62.0 | 62.6 | 61.4 | 61.3 | 59.3 | 48.8 | 51.7 |

FC-035 | 52.2 | 47.9 | 55.0 | 53.9 | 53.7 | 56.3 | 51.5 | 49.6 |

FC-037 | 56.0 | 46.8 | 43.1 | 43.5 | 51.4 | 60.0 | 62.0 | 58.1 |

FC-039 | 60.3 | 58.8 | 57.6 | 58.5 | 59.2 | 62.4 | 61.0 | 57.1 |

FC-041 | 54.8 | 54.6 | 50.3 | 55.0 | 58.1 | 62.1 | 51.8 | 56.5 |

FC-043 | 61.0 | 61.3 | 63.6 | 63.4 | 64.3 | 64.9 | 59.8 | 58.6 |

FC-046 | 52.9 | 59.0 | 63.6 | 59.2 | 60.0 | 60.1 | 47.9 | 52.7 |

FC-048 | 57.6 | 51.2 | 46.8 | 49.8 | 56.7 | 59.1 | 58.5 | 58.3 |

FC-051 | 55.0 | 55.3 | 52.3 | 53.8 | 56.7 | 58.8 | 52.5 | 55.3 |

FC-054 | 54.1 | 55.8 | 58.3 | 54.4 | 59.6 | 56.6 | 45.6 | 55.5 |

FC-058 | 60.5 | 54.4 | 55.9 | 57.7 | 59.6 | 60.2 | 62.8 | 60.1 |

FC-061 | 51.1 |

| 58.1 | 57.1 | 56.0 | 47.6 | 38.6 | 42.0 |

FC-063 | 52.2 |

| 56.6 | 55.5 | 54.9 | 52.7 | 46.4 | 53.5 |

FC-064 | 55.1 |

| 58.1 | 57.1 | 57.0 | 55.7 | 51.0 | 54.7 |

FC-065 | 52.0 |

| 55.0 | 55.4 | 53.3 | 51.7 | 48.8 | 51.1 |

FC-071 | 51.6 |

| 53.9 | 53.0 | 52.5 | 52.8 | 47.4 | 52.8 |

FC-074 | 53.7 |

| 54.6 | 53.2 | 54.3 | 54.1 | 53.7 | 52.7 |

FC-075 | 56.7 |

| 57.4 | 57.0 | 57.5 | 56.5 | 51.2 | 59.6 |

FC-077 | 56.8 |

| 57.4 | 57.3 | 57.9 | 56.3 | 55.0 | 58.3 |

FC-078 | 52.0 |

| 59.9 | 55.2 | 52.5 | 52.0 | 51.4 | 52.1 |

FC-094 | 53.9 |

| 58.0 | 55.7 | 56.9 | 55.8 | 50.7 | 53.2 |

FC-122 | 50.9 |

| 59.5 | 59.3 | 56.4 | 53.0 | 47.2 | 55.4 |

FC-123 | 51.2 |

| 56.5 | 53.9 | 53.5 | 51.8 | 47.8 | 56.4 |

FC-131 | 51.6 |

| 57.8 | 56.6 | 56.3 | 50.5 | 41.4 | 41.8 |

FC-146 | 59.8 |

| 63.1 | 61.6 | 58.2 | 56.5 | 60.1 | 65.8 |

FC-151 | 54.5 |

| 59.5 | 59.9 | 60.0 | 56.7 | 48.7 | 48.2 |

FC-159 | 56.1 |

| 63.2 | 63.6 | 62.8 | 59.3 | 48.3 | 51.4 |

FC-160 | 51.6 |

| 60.4 | 61.6 | 59.4 | 56.2 | 42.8 | 42.5 |

FC-161 | 52.1 |

| 56.2 | 57.8 | 57.4 | 53.8 | 54.3 | 46.1 |

FC-162 | 58.2 |

| 64.7 | 63.7 | 63.9 | 59.5 | 44.9 | 45.8 |

FC-169 | 52.1 |

| 59.5 | 58.6 | 57.4 | 49.8 | 43.8 | 42.8 |

FC-170 | 53.1 |

| 57.2 | 56.4 | 55.4 | 56.0 | 48.2 | 35.4 |

Quality Assurance

Chemical analysis was performed at ALS Laboratories. Metal Oxides are determined using XRF analysis. Fusion disks are made with pulped samples and the addition of a borate-based flux. Analysis at ALS is for a 24-element suite. FeO is determined using titration and LOI using loss determination by thermogravimetric analysis at 1000°C.

Max did not insert standards or blanks in the assay stream and is relying on ALS's lab QA/QC. The ALS lab inserts its own standards at set frequencies and monitors the precision of the XRF analysis. These results reported well within the specified 2 standard deviations of the mean grades for the main elements.

Proposed IPO of Max Brazil Iron Ltd. (“Max Brazil”) to the Official List of the ASX

Further to its news releases on December 12, 2024, January 2, 2025, January 7, 2025, January 9, 2025, and January 20, 2025, Brazil Iron has closed the third tranche of its non-brokered private placement for a new aggregate amount of 27,300,000 ordinary shares in the capital of Max Brazil (the “Ordinary Shares”) at a price of AUD $0.10 per Ordinary Share for aggregate gross proceeds AUD $2,730,000. Following the completion of the third tranche Offering, the Company owns approximately 76.5% of the issued and outstanding Ordinary Shares.

At the special meeting held on February 26, 2025, shareholders of the Company approved an ordinary resolution approving the undertaking of an initial public offering by the Company’s majority owned subsidiary, Max Iron Brazil. There was overwhelming support with 99.55% of shares voted at the meeting in favour of the resolution.

Max Iron Brazil has received In-Principle Advice on suitability from ASX Limited (the “ASX”) to advance plans for admission to the official list of the Australian Securities Exchange. Max Brazil plans to lodge a Prospectus with the Australian Securities and Investments Commission in Q2 2025. ASX confirmed the ticker code MAX has been reserved for Max Brazil.

Max Brazil plans to complete an initial public offering of a minimum of 30,000,000 Ordinary Shares in the capital of Max Brazil (the “Ordinary Shares”) at a price of AUD $0.20 per Ordinary Share for minimum aggregate gross proceeds of AUD $6,000,000 up to a maximum of 50,000,000 Ordinary Shares for maximum aggregate proceeds of AUD $10,000,000 (the “Offering”).

Following the completion of the Offering Max will continue to be a controlling shareholder in Max Brazil holding 88,000,000 ordinary shares and 12,000,000 performance shares.

The net proceeds of the Offering to be used, among other things, for the advancement of the Florália DSO Project, and for general working capital purposes.

Max Brazil will be subject to applicable Australian securities legislation and the rules and regulations of the ASX. There is no guarantee that the proposed IPO or listing of Max Brazil on the ASX will be completed on the terms set out in this announcement or at all. Closing of the IPO is subject to a number of conditions, including receipt of all necessary corporate and regulatory approvals.

Sierra Azul Copper-Silver Project Background

The Company’s wholly owned Sierra Azul Project sits along the Colombian portion of the world’s largest producing copper belt (Andean belt), with world-class infrastructure and the presence of global majors (Glencore and Chevron).

Max has an Earn-In Agreement (“EIA”) with Freeport-McMoRan Exploration Corporation (“Freeport”), a wholly- owned affiliate of Freeport-McMoRan Inc. (“NYSE: FCX”) relating to the Sierra Azul Project. Under the terms of the EIA, Freeport has been granted a two-stage option to acquire up to an 80% ownership interest in the Sierra Azul Project by funding cumulative expenditures of C$50 million and making cash payments to Max of C$1.55 million.

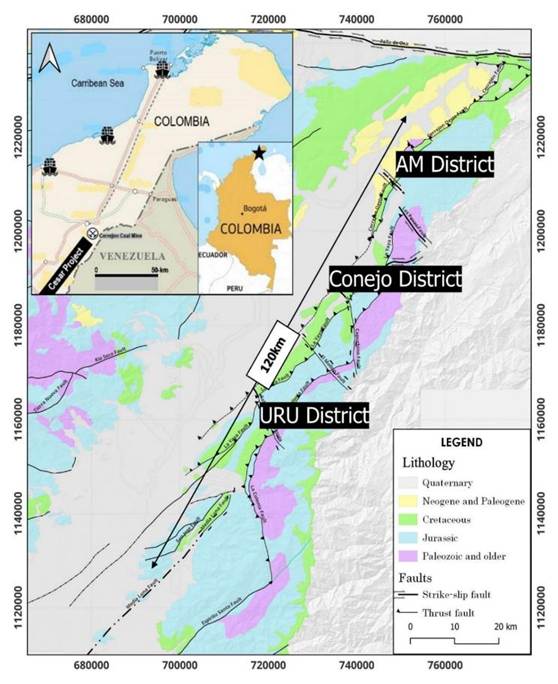

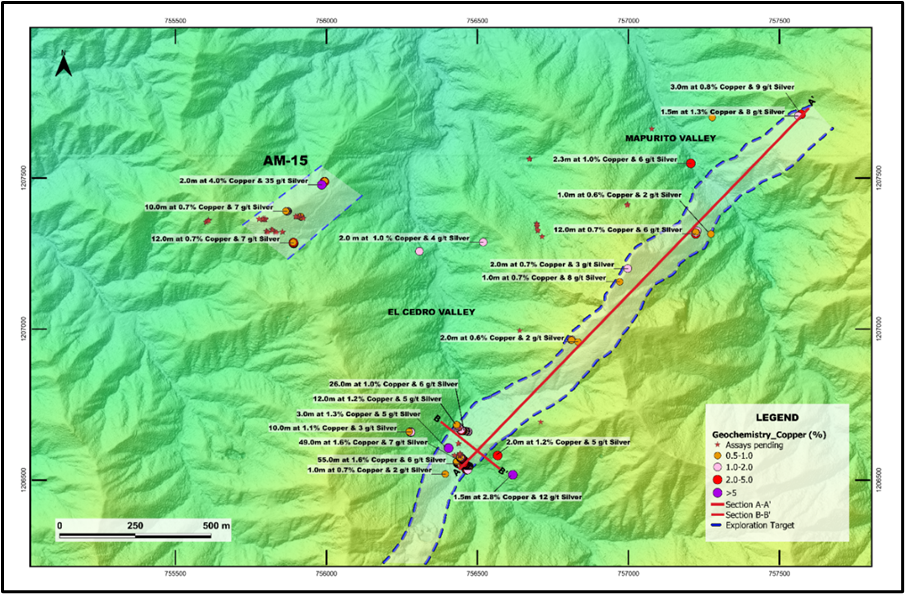

Sierra Azul comprises three districts: AM, Conejo and URU. Collectively the three contiguous districts stretch over 120 km in NNE/SSW direction (refer to Figure 4). Max Resource’s land tenure at Sierra Azul includes 188 km² of mining concessions and 1,141 km² of mineral concession applications.

Figure 4: Sierra Azul Copper Silver Project comprises three districts: AM, Conejo and URU

Collectively the three contiguous Districts stretch over 120 km in NNE/SSW direction

AM-13: Exploration Target Increased to 1,500m by 100m

- Copper-silver mineralization identified over 1,500m of strike and open ended

- New composite channel assay results include:

- 1.6% Copper & 6 g/t Silver over 55.0m (CS11)

- 1.6% Copper & 7 g/t Silver over 49.0m (CS08)

- 1.0% Copper & 6 g/t Silver over 26.0m (CS01)

- The 100m wide mineralized body rises over 300m in elevation between El Cedro and Mapurito valleys suggesting significant depth potential

- Manto-style mineralization and alteration, similar to deposits in the Tocopilla – Taltal region of northern Chile, where a mineralized corridor extends well over 100-km and hosts several economic deposits including Mantos Blancos estimated to contain 500mt at 1% Copper (Reference material on the Mantos Blancos deposit available here)

Max cautions investors copper-silver mineralization at Mantos Blancos is not necessarily indicative of similar mineralization at Sierra Azul.

- Manto-style mineralization and alteration, similar to deposits in the Tocopilla – Taltal region of northern Chile, where a mineralized corridor extends well over 100-km and hosts several economic deposits including Mantos Blancos estimated to contain 500mt at 1% Copper (Reference material on the Mantos Blancos deposit available here)

AM-15: Discovery of New Manto Style Target Proximal to AM-13

- The new AM-15 discovery is located approximately 1,000m northwest of AM-13

- Early work suggests a large target footprint with five mineralized outcrops already identified over a 100m by 300m and open in all directions

- High priority target based on potential size, grade and proximity to AM-13

Figure 5: AM-13 & AM-15 Target Zone

Image showing extended footprint of AM-13 in relation to the AM-15 discovery

Freeport McMoRan Funded US $4.8 Million Approved Exploration Budget for 2025

The 2025 exploration program at the Sierra Azul has three objectives: Drill Target Development, District Scale Exploration and Basin Scale Analysis.

Drill Target Development

The Drill Target Development program will focus exploration on priority targets located in all three districts of the Sierra Azul Project: AM, Conejo and URU. The goal of the program is to prepare the selected targets for drilling. The work program is well under way and includes detailed geological mapping and soil sampling as well as planned ground geophysical surveys and detailed structural analysis.

District Scale Exploration

The District Scale Exploration Program commenced in 2024 and is designed to systematically evaluate the entire Sierra Azul Project area with the goal of identifying additional priority targets for follow-up. The program has two components: soil and stream sediment sampling

The district-scale soil sampling program comprises a total of 3,646 samples collected at 50m intervals along lines spaced 2,000m apart. The sampling campaign commenced in 2024 and approximately 27% of the planned samples have been collected.

Qualified Person

The Company's disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, P.Geo (British Columbia), a member of the Max Resource advisory board, who serves as a qualified person under the definition of National Instrument 43-101.

For more information visit on Max Resource: https://www.maxresource.com/

For more information visit on Max Brazil: https://maxironbrazil.com/

For additional information contact:

Tim McNulty

E: info@maxresource.com

T: (604) 290-8100

Rahim Lakha

E. rahim@bluesailcapital.com

Brett Matich

T: (604) 484 1230

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law.

Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company’s control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein.

The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s filings with Canadian securities regulators, which filings are available at www.sedarplus.ca.

Back to Past News