Max to Acquire North Choco Gold-Copper Assets Contiguous to AngloGold Ashanti and Continental Gold Properties

Vancouver B.C., May 8, 2019 – MAX RESOURCE CORP. (“Max” or the “Company”) (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D1) is pleased to announce that it has entered into a binding Letter of Intent (the “LOI”) dated May 7, 2019 with Noble Metals Limited and Buena Fortuna Mining Company Pty Ltd. (together, the “Vendors”) whereby the Vendors shall grant an option to Max to acquire up to 100% of their interest in Andagueda Mining Pty Ltd. (“Andagueda”) which holds an exploration and mining Agreement with the Tahami Indigenous Reservation of Alto Andagueda (“TAHAMI”) for the North Choco Gold-Copper Project (“North Choco”).

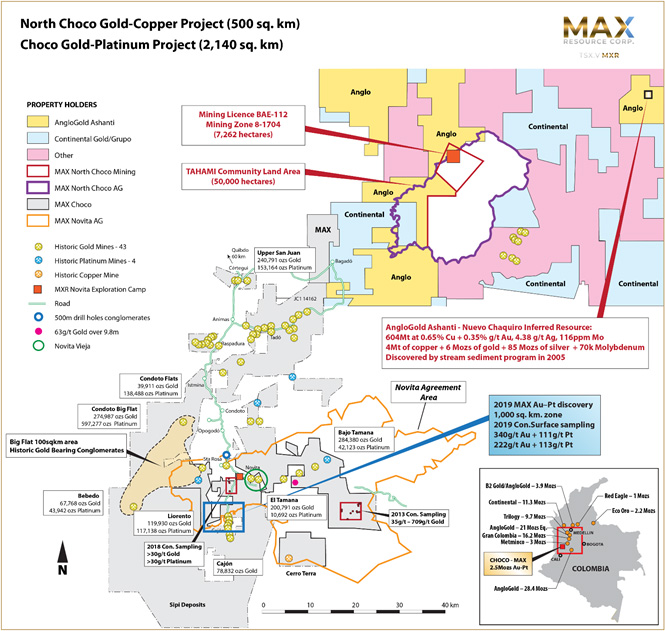

North Choco is located adjacent and trending to the NE of the Company’s 2,140 sq. km Choco Gold-Platinum Project (“Choco”), located 100km SW of Medellin, Colombia with the following highlights:

Through Andagueda’s historic agreement, North Choco encompasses TAHAMI’s 500 sq. km land area, and includes exploration and development of economic mineral resources on: Indigenous Communities Mining Zone 8-1704 covering 6535.7 hectares and Mining Concession BAE-112 covering 720.6 hectares;

Andagueda conducted a reconnaissance visit of the North Choco property in January 2019, concentrating on the historic gold mines taking 14 samples, including the following channel samples:

- 0.3m at 262.0 g/t gold + 0.57% copper + 941 ppm cobalt

- 2m at 29.1 g/t gold

- 1.6m at 20.7 g/t gold + 592 ppm cobalt

- 0.3m at 49.3 g/t gold + 11.4% copper + 502 ppm cobalt

North Choco is located 47 km SW of AngloGold Ashanti’s Nuevo Chaquiro porphyry copper discovery;

- AngloGold’s 03-Nov-2014 News Release announced an initial Inferred Resource of 604Mt at 0.65% copper and 0.32g/t gold for contained metal content of 3.95Mt of copper and 6.13Moz of gold. This is one of five known porphyry centres concentrated within a 15 sq. km area; Max cautions investors it has not yet verified the Andagueda and AngloGold sampling data. Max further cautions investors mineralization on the Nuevo Chaquiro property is not necessarily indicative of similar mineralization at North Choco.

- AngloGold’s initial reconnaissance in 2005 within the North Choco property area identified pyrite, chalcopyrite, galena, sphalerite and arsenopyrite, in a matrix of quartz and calcite from historic gold mines and copper porphyry prospects; there was no follow up because of access restrictions;

The North Choco property significantly expands Max’s Choco landholdings from 2,140 to 2,640 sq. km, with North Choco contiguous to properties held by AngloGold Ashanti and Continental Gold;

Exploration at North Choco will initially focus on verification and follow up of the historic mining activities and the AngloGold and Andagueda exploration data within the 720.6 hectare mining lease and expanding to the 6535.7-hectare Mining Area and the 500 sq. km community area.

“Max has achieved a significant opportunity, with the TAHAMI community’s much sought out mineral properties,” commented Max Resource CEO, Brett Matich. “This acquisition adds leverage to Max’s copper holdings and compliments its existing gold and platinum portfolio, as historic government surveys suggest the North Choco project has excellent potential for porphyry copper,” he continued.

North Choco Gold-Copper Project

Through the acquisition of Andagueda, North Choco will add 500 sq. km to Max’s Choco project, bringing the consolidated landholdings to 2,640 sq. km. North Choco is contiguous to properties held by AngloGold Ashanti and Continental Gold and is located approximately 80km SE of the City of Medellin, Colombia.

The terms of the February 7, 2019 Exploration and Exploitation Operation Development and Participation in Net Profits Agreement with Tahami Indigenous Reservation of Alto Andagueda (the “TAHAMI Agreement”) provides North Choco certain mineral rights over the 500 sq. km area including the exploration and development of economic mineral resources on Indigenous Communities Mining Zone 8-1704 covering 6535.7 hectares, granted July 29 1996 and Mining Concession Contract BAE-112 covering 720.6 hectares is a fully granted exploration, development and mining license granted June 26, 2001.

The main veins at Mina Morron have been explored and mined since the late 1800’s, with production periods in 1929-1930 and 1948-1968. The geology of the North Choco project consists of Cretaceous mudstones to sandstone in the east and Palecone to Eocene basalts, breccias, agglomerates and tuffs in the west. These units are intruded by the monzonites and tonalites of the Miocene Farallones batholith. Presently known mineralization, largely quartz veins, is hosted in the basalts and the intrusive, with historic exploration confined to the 720.6-hectare mining lease.

In 2005, AngloGold Ashanti conducted a site visit targeting the copper porphyry potential of North Choco; this resulted in identification of pyrite, chalcopyrite, galena, sphalerite and arsenopyrite, in a matrix of quartz and calcite from historic gold mines and copper porphyry prospects, however, AngloGold was unable to follow up the anomaly’s because of land access restrictions.

Located on trend and 47km NE of North Choco, AngloGold’s Nuevo Chaquiro discovery was the result of a systematic stream sediment geochemistry survey initiated in 2004. Follow up of a modest localized gold anomaly led to identification of the “Discovery Outcrop” in 2005. In 2014 AngloGold reported a maiden Inferred Resource of 604Mt at 0.65% copper and 0.32g/t gold for contained metal content of 3.95Mt of copper and 6.13Moz of gold.; This is one of five known porphyry centres concentrated within a 15 sq. km area.

The Nuevo Chaquiro deposit was a blind discovery resulting from identification porphyry style alteration and mineralization during follow up of a regional stream sediment sampling survey. The geology of Nuevo Chaquiro consists of Miocene tuffs, andesites, basalts and agglomerates intruded by small stocks and dykes of Miocene diorites and quartz diorites.

Site visit and exploration programs

Andagueda conducted a reconnaissance visit of the North Choco property in January 2019, concentrating on the historic gold mines, taking 14 channel samples and four chip samples, 7 of 14 samples assayed above 1 g/t and up to 262 g/t gold, plus copper graded up to 11.4%.

The Max exploration team is currently at North Choco completing preliminary exploration. The team is mapping and sampling the historic Mina Morron, Mina Paloma and Mine La Esmeralda gold mines. They are also sampling other Colonial occurrences within both the mining area and the TAHAMI Community Area.

After completing the preliminary exploration phase, the Max exploration team will commence a property wide stream sediment sampling and prospecting program with the assistance of members of the greater TAHAMI community. The community members will be able to guide the Max geologists to outcrop and mineralization locations handed down generation to generation. The methodology of the program will be similar to the effective program utilized by AngloGold Ashanti that lead to the Nuevo Chaquiro discovery.

|

Sample No. |

Location |

Sample Type |

Sample Width (m) |

Description |

Gold (g/t) |

Copper (ppm) |

Cobalt (ppm) |

|

051455 |

Morron |

Channel |

0.3 |

Massive po, cp, qz cut by qz veinlets. |

262.000 |

5740 |

941 |

|

051456 |

Morron |

Channel |

2.0 |

Diorite, ch alteration, ac veinlets, qz, (po). |

29.100 |

66 |

37 |

|

051461 |

Paloma |

Channel |

1.6 |

Fine grained dark green - gray rock, veinlets qz, massive sulphides, ap, cp. |

20.700 |

464 |

592 |

|

051457 |

Morron |

Channel |

0.1 |

Massive mt, po, cp, minor qz veinlets. |

49.300 |

114000 |

502 |

|

051453 |

Morron |

Channel |

0.3 |

Qz veinlets flat, po, mt, (cp). |

5.990 |

308 |

46 |

|

051460 |

Morron |

Channel |

0.3 |

Vein qz, po, se? |

4.700 |

1005 |

353 |

|

051459 |

Morron |

Channel |

0.5 |

Massive po & f. g. dark green rock, veinlets qz, po, (cp), disseminated mt, po. |

1.145 |

1710 |

192 |

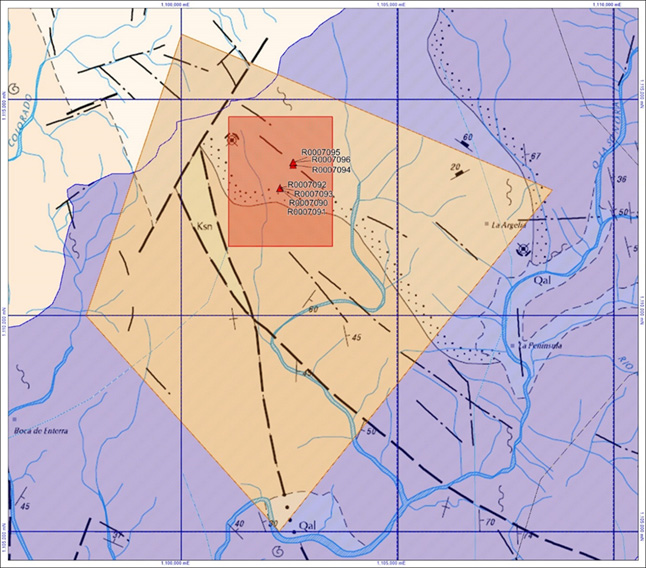

Andagueda Channel Sampling & AngloGold Ashanti Sampling Locations within Mining License BAE-112

Choco Gold-Platinum Project

Exploration at Choco continues, focusing on expanding the area underlain by the gold-bearing conglomerates outside of the 1,000 sq. km exploration area. Testing of the base of the surface gravels will continue as well to establish zones of gold enrichment to assist in targeting zones of enrichment in the underlying conglomerates.

Net Profit Return

Under the terms of the TAHAMI Agreement, the TAHAMI Council is entitled to a 12.5% of Net Profit Return to the Council and a 5% of Net Profit Return to the Committee from any production, from any present or future mining areas within the TAHAMI 500 sq. km land area.

Net Profit Return is a non-IFRS measure defined in the TAHAMI Agreement to mean: gross proceeds derived from the sale of the mineral, less all outgoings, costs, charges and expenses incurred in relation to the mining rights and production of the mineral, deductions include all exploration, development and pre-production expenditures, reclamation costs, amortized capital costs and all expenses including but not limited to all mining, crushing, treatment, processing, smelting, refining, transporting, assaying, sampling, handling, storage, sales costs, insurance, rents, marketing and any other related costs.

About the Transaction

Under the terms of the binding LOI, Max and the Vendors shall enter into a definitive agreement pursuant to which Max shall earn an initial 51% interest in Andagueda, and an option to acquire the remaining 49% (the “Option”) by paying a non-refundable cash payment of CAD $25,000 to the Vendors within five days of the signing of the LOI, and by issuing an aggregate of 12,750,000 common shares of Max to the Vendors upon the closing of the Transaction (the “Closing”).

In order to exercise the Option and acquire the remaining 49% interest in Andagueda (for a total of a 100% interest), Max may issue an additional 12,250,000 common shares of Max to the Vendors and incur exploration and development expenditures of at least CAD $500,000 on or before the date that is twelve (12) months after the date on which Closing occurs.

If the parties have not executed a definitive agreement in respect of the transaction on or before 180 days from May 7,2019, Max may elect to terminate the LOI.

There are a number of conditions precedent to the closing of the transaction which include the completion of due diligence, the execution of a definitive agreement, and board, regulatory, and TSX Venture Exchange approvals. There are no finders’ fees payable in connection with the proposed transaction.

About Max Resource Corp.

MAX is a mineral exploration company focused on the development and acquisition of prospective projects in the rich mineral belts of Colombia. The Company has established significant exploration infrastructure and local community support for the Choco Gold and Platinum Project, located 100 km south of Medellin, which covers or is adjacent to historic production of 1.5Mozs gold and 1.0Mozs platinum. The Company’s Gachala Copper Project, is located 60 km east of Bogota. The Company is led by a seasoned management team with a track record of significant discovery and exploration success. Source: R.J. Fletcher and Associates (2011) Review of Gold and Platinum Exploration and Production in Choco Province Colombia Part 3. Private Report for Condoto Platinum Ltd.)

MAX cautions investors it has yet to verify the Choco Gold and Platinum Project historic information.

Tim Henneberry, PGeo (British Columbia), a member of the Max Resource advisory board, is the qualified person who has reviewed and approved the technical content of this news release on behalf of the company.

For more information visit: https://www.maxresource.com/

For additional information contact:

|

Max Resource Corp. E: info@maxresource.com |

For Max Resource’s French inquiries: Remy Scalabrini, Maricom Inc. T: (888) 585-MARI |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company’s control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s filings with Canadian securities regulators, which filings are available at www.sedar.com

Back to Past News