Max Resource Provides Update on its Florália Hematite Iron Ore Project, Mina Gerais State, Brazil

Vancouver B.C., November 15, 2024 – MAX RESOURCE CORP. (“Max” or the “Company”) (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) is pleased to provide an update in relation to the Company’s news release dated November 4, 2024. The Company has added a wholly owned Australian entity, Max Iron Brazil Ltd. (“Max Brazil”) to hold the “Florália Brazilian Assets” through the existing Canadian and Brazilian holding entities. The Company plans to seek listing on the ASX Limited ("ASX" or "Australian Stock Exchange"), prior to a pre-listing financing directly into Max Brazil to fund the proposed transaction and to advance drilling.

Florália Hematite Exploration Update

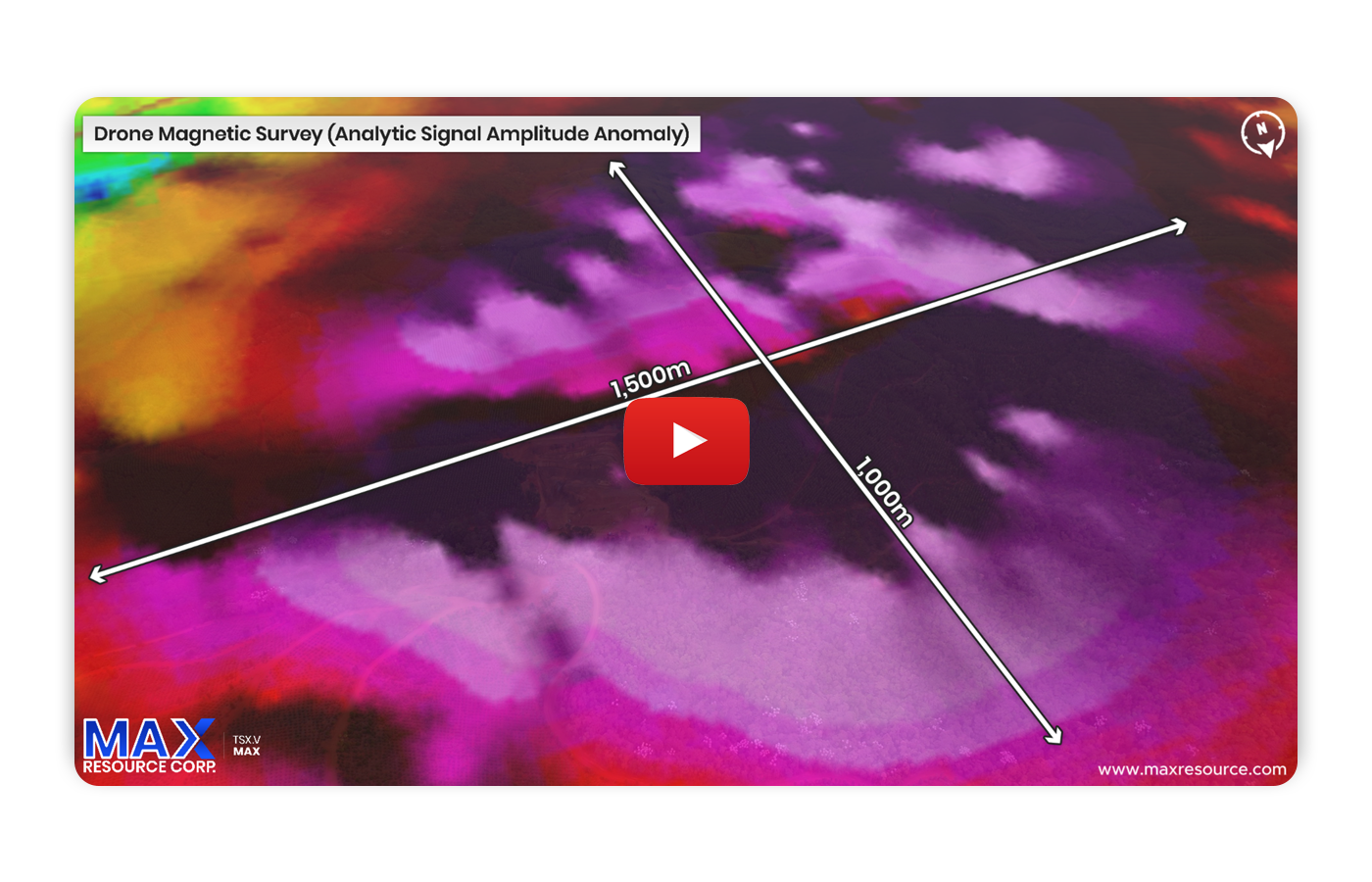

Max Resource reports high-resolution drone magnetics at Florália has identified a large anomalous zone of surficial outcropping high-grade mineralization associated with hematite/itabirite type iron formation. The size of the anomalous area has far exceeded the approximate 160m by 160m historic open cut to around 1,500m by 1,000m based on the drone magnetics, field activities and 58 channel samples (Refer to Figure 1).

Max’s technical team has reviewed the new drone magnetics and channel sampling data and has significantly expanded the Florália hematite geological target from 8 to 12 million tons at 58% Fe to 50 to 70 million tonnes at 55% to 61% Fe, with an additional itabirite geological target of 130 to 170 million tonnes at 51% to 55% Fe.

Max cautions investors the potential quantity and grade of the iron ore is conceptual in nature, and further cautions there has been insufficient exploration to define a mineral resource, and Max is uncertain if further exploration will result in the target being delineated as a mineral resource.

Hematite mineralization tonnage potential estimation is based on in situ high-grade outcrops and interpreted and modelled magnetic anomalies. Density value used for the estimate is 2.8t/m³. Hematite sample grades range between 55-61%Fe. Itabirite mineralization tonnage potential estimation is based on in situ itabirite outcrop interpreted and modelled magnetic anomalies. Density value used for the estimate is 2.5t/m3. Itabirite sample grades range between 51-55%Fe. The 58 channel samples were collected for chemical analysis from in situ outcrops in previously mined slopes of industrial materials. Channel samples weighed in average 14 kg. Chemical analysis was performed at ALS Laboratories. Metal Oxides are determined using XRF analysis. Fusion disks are made with pulped samples and the addition of a borate-based flux. Max did not insert standards or blanks in the assay stream and is relying on ALS's lab QA/QC. Refer to Table 1 and 2.

Figure 1. Video highlighting the high-resolution magnetic signature and field activities.

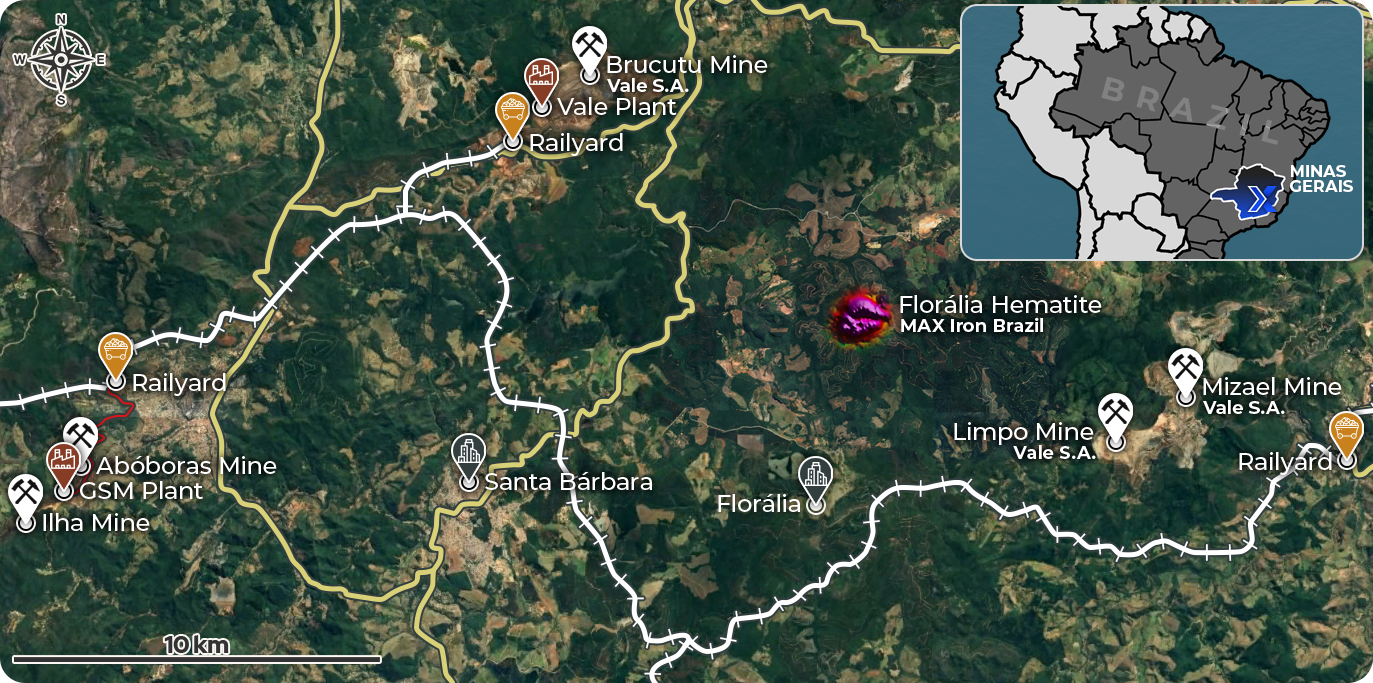

The Florália Hematite project is located 70-km east of the city of Belo Horizonte, Minas Gerais, Brazil’s largest iron ore and steel producing State. In addition, iron ore buyers lie within 20-km of Florália, providing a local ready market requiring minimal transportation, upon successful exploration and development (see Figure 2).

The processed geophysical data from the drone survey also indicates a large portion of the magnetic anomaly lies at depth below the surface expressions of high-grade hematite oxide mineralization. Analysis indicates a highly deformed structural geological environment that is fundamental to the increase in iron ore grades and tonnages, a consequence of secondary crystallization of hematite and the development of supergene enrichment. Additionally, the geophysical survey was also crucial in revealing the potential of a secondary body covered by soil in the northwest portion of the property. This zone was initially regarded as a minor occurrence; however, the magnetic signature and orientation recognizes it as extensions to the initial iron formation target.

The Magnetometric Geophysical survey utilized drones over the project area located in the Florália region of Santa Bárbara, Minas Gerais, Brazil, within the “Quadrilátero Ferrífero” region. The geophysical survey magnetometric maps were generated with multiples filters along with a 3D inversion that provided a high-resolution block model and isovalue surfaces from the interpreted source of the anomalies. This data has been fundamental in confirming the principal target area and the true potential of the Florália high-grade hematite project.

The channel sampling across road cuts is now complete with assays pending. Next step is auger and diamond drilling.

Figure 2. Iron Ore Buyers within 20-km Radius of the Florália Hematite Iron Ore Project

Table 1. Max Hematite Channel Sample Results

Sample ID | Type | +16mm | -16mm | Type | %Fe | %SiO2 | %P | %Al2O3 | % Loi |

FL_CN_001 | Fraction | 9.7% | 90.3% | Hematite | 57.55 | 4.49 | 0.06 | 5.84 | 6.76 |

FL_CN_003 | Fraction | 12.5% | 87.5% | Hematite | 58.26 | 4.74 | 0.04 | 3.65 | 7.50 |

FL_CN_005 | Fraction | 23.2% | 76.8% | Hematite | 57.36 | 13.19 | 0.05 | 0.70 | 3.10 |

FL_CN_006 | Fraction | 15.7% | 84.3% | Hematite | 58.32 | 7.60 | 0.02 | 1.77 | 6.52 |

FL_CN_007 | Fraction | 13.8% | 86.2% | Hematite | 56.56 | 10.38 | 0.02 | 3.43 | 4.98 |

FL_CN_009 | Fraction | 19.7% | 80.3% | Hematite | 58.87 | 5.82 | 0.03 | 3.37 | 6.06 |

FL_CN_010 | Fraction | 11.4% | 88.6% | Hematite | 58.09 | 3.21 | 0.07 | 5.31 | 7.64 |

FL_CN_012 | Fraction | 9.8% | 90.2% | Hematite | 55.15 | 11.07 | 0.02 | 2.95 | 5.80 |

FL_CN_017 | Fraction | 9.9% | 90.1% | Hematite | 58.06 | 8.45 | 0.06 | 2.19 | 5.34 |

FL_CN_018 | Raw_grade | Hematite | 56.28 | 10.35 | 0.06 | 2.42 | 5.66 | ||

FL_CN_019 | Fraction | 9.9% | 90.1% | Hematite | 58.66 | 7.67 | 0.04 | 3.03 | 4.95 |

FL_CN_022 | Fraction | 12.1% | 87.9% | Hematite | 56.78 | 5.15 | 0.04 | 5.57 | 6.96 |

FL_CN_024 | Fraction | 4.3% | 95.7% | Hematite | 59.80 | 7.11 | 0.04 | 1.73 | 4.61 |

FL_CN_025 | Raw_grade | Hematite | 55.82 | 13.30 | 0.06 | 1.31 | 4.44 | ||

FL_CN_026 | Raw_grade | Hematite | 55.68 | 9.64 | 0.04 | 4.76 | 5.70 | ||

FL_CN_027 | Raw_grade | Hematite | 55.97 | 7.33 | 0.10 | 2.50 | 7.36 | ||

FL_CN_030 | Fraction | 15.0% | 85.0% | Hematite | 56.38 | 2.11 | 0.06 | 6.80 | 9.54 |

FL_CN_031 | Fraction | 18.4% | 81.6% | Hematite | 56.35 | 9.35 | 0.04 | 3.39 | 4.75 |

FL_CN_033 | Raw_grade | Hematite | 55.96 | 7.00 | 0.05 | 4.52 | 6.58 | ||

FL_CN_037 | Fraction | 17.3% | 82.7% | Hematite | 56.04 | 1.96 | 0.11 | 7.84 | 9.22 |

FL_CN_039 | Fraction | 6.8% | 93.2% | Hematite | 60.25 | 4.28 | 0.10 | 1.69 | 6.41 |

FL_CN_040 | Raw_grade | Hematite | 56.35 | 11.60 | 0.05 | 1.97 | 4.82 | ||

FL_CN_042 | Raw_grade | Hematite | 56.67 | 11.15 | 0.05 | 2.76 | 5.46 | ||

FL_CN_043 | Fraction | 6.8% | 93.2% | Hematite | 61.04 | 7.43 | 0.04 | 1.32 | 4.50 |

FL_CN_045 | Raw_grade | Hematite | 56.32 | 10.85 | 0.03 | 2.44 | 4.89 | ||

FL_CN_047 | Raw_grade | Hematite | 56.20 | 12.15 | 0.05 | 1.57 | 4.56 | ||

FL_CN_048 | Fraction | 9.0% | 91.0% | Hematite | 57.59 | 3.24 | 0.08 | 4.03 | 9.00 |

FL_CN_049 | Raw_grade | Hematite | 58.42 | 5.08 | 0.07 | 3.51 | 7.33 | ||

FL_CN_050 | Raw_grade | Hematite | 55.05 | 9.33 | 0.05 | 3.43 | 6.48 | ||

FL_CN_053 | Raw_grade | Hematite | 56.77 | 7.05 | 0.05 | 5.44 | 5.78 | ||

FL_CN_055 | Raw_grade | Hematite | 56.34 | 11.75 | 0.05 | 1.75 | 4.94 | ||

FL_CN_057 | Raw_grade | Hematite | 58.34 | 9.74 | 0.07 | 1.76 | 4.07 | ||

FL_CN_058 | Fraction | 12.6% | 87.4% | Hematite | 60.46 | 2.83 | 0.05 | 3.57 | 6.17 |

FL_CN_059 | Raw_grade | Hematite | 59.69 | 4.77 | 0.05 | 3.38 | 5.84 |

Table 2. Max Itabirite Channel Sample Results

SampleID | Type | +16mm | -16mm | Type | %Fe | %SiO2 | %P | %Al2O3 | %Loi |

FL_CN_002 | Fraction | 7.6% | 92.4% | Itabirite | 54.89 | 7.63 | 0.06 | 3.87 | 9.27 |

FL_CN_004 | Fraction | 8.0% | 92.0% | Itabirite | 52.29 | 8.57 | 0.06 | 6.22 | 9.74 |

FL_CN_008 | Fraction | 11.6% | 88.4% | Itabirite | 53.72 | 12.44 | 0.02 | 3.80 | 5.91 |

FL_CN_013 | Fraction | 14.2% | 85.8% | Itabirite | 52.20 | 6.62 | 0.08 | 7.81 | 10.07 |

FL_CN_015 | Raw_grade | Itabirite | 51.13 | 5.01 | 0.15 | 8.34 | 11.32 | ||

FL_CN_016 | Raw_grade | Itabirite | 54.48 | 7.89 | 0.05 | 6.42 | 7.48 | ||

FL_CN_021 | Fraction | 13.6% | 86.4% | Itabirite | 52.82 | 5.67 | 0.07 | 6.19 | 10.54 |

FL_CN_023 | Raw_grade | Itabirite | 52.61 | 12.25 | 0.07 | 1.64 | 7.33 | ||

FL_CN_029 | Fraction | 17.2% | 82.8% | Itabirite | 51.44 | 5.88 | 0.08 | 8.32 | 10.03 |

FL_CN_032 | Raw_grade | Itabirite | 53.64 | 13.20 | 0.04 | 4.16 | 5.18 | ||

FL_CN_034 | Raw_grade | Itabirite | 53.13 | 12.55 | 0.04 | 4.60 | 5.55 | ||

FL_CN_035 | Fraction | 5.3% | 94.7% | Itabirite | 52.18 | 16.72 | 0.04 | 2.87 | 5.55 |

FL_CN_036 | Raw_grade | Itabirite | 53.73 | 12.75 | 0.07 | 3.53 | 6.26 | ||

FL_CN_041 | Fraction | 8.7% | 91.3% | Itabirite | 54.82 | 13.79 | 0.03 | 2.84 | 4.92 |

FL_CN_044 | Raw_grade | Itabirite | 51.85 | 14.40 | 0.03 | 4.05 | 5.89 | ||

FL_CN_046 | Fraction | 4.0% | 96.0% | Itabirite | 52.92 | 17.47 | 0.04 | 1.75 | 4.50 |

FL_CN_051 | Fraction | 12.7% | 87.3% | Itabirite | 54.98 | 11.01 | 0.04 | 4.63 | 5.39 |

FL_CN_052 | Raw_grade | Itabirite | 54.04 | 12.45 | 0.04 | 3.46 | 5.75 | ||

FL_CN_054 | Fraction | 10.6% | 89.4% | Itabirite | 54.09 | 11.62 | 0.09 | 3.73 | 7.01 |

FL_CN_056 | Raw_grade | Itabirite | 54.96 | 16.30 | 0.06 | 1.52 | 3.27 |

Qualified Person

The Company's disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, P.Geo (British Columbia), a member of the Max Resource advisory board, who serves as a qualified person under the definition of National Instrument 43-101.

About Max Resource Corp.

Max Resource Corp. (TSXV: MAX) is a mineral exploration company advancing the newly discovered district-scale wholly owned Sierra Azul Copper-Silver Project in Colombia.

The Sierra Azul Project sits along the Colombian portion of the world’s largest producing copper belt (Andean belt), with world-class infrastructure and the presence of global majors (Glencore and Chevron). Max has an Earn-In Agreement (“EIA”) with Freeport-McMoRan Exploration Corporation (“Freeport”), a wholly owned affiliate of Freeport-McMoRan Inc. (“NYSE: FCX”) relating to the Sierra Azul Project. Under the terms of the EIA, Freeport has been granted a two-stage option to acquire up to an 80% ownership interest in the Sierra Azul Project by funding cumulative expenditures of C$50 million and making cash payments to Max of C$1.55 million. Max is the operator of the initial stage. The USD $4.2 million 2024 exploration program for the Sierra Azul Project is funded by Freeport.

The Company wholly owns the Florália Hematite Iron Ore Project, located 70-km SE of Belo Horizonte, Minas Gerais, Brazil’s largest iron ore producing State. The Company has added an Australian entity, Max Iron Brazil Ltd. (“Max Brazil”), to hold the “Florália Brazilian Assets” through the existing Canadian and Brazilian holding entities. The Company plans to seek listing on the ASX Limited ("ASX" or "Australian Stock Exchange"), prior to a pre-listing financing directly into Max Brazil to fund the proposed transaction and to advance drilling at the Florália project.

For more information visit: https://www.maxresource.com/.

For additional information contact:

Tim McNulty

E: info@maxresource.com

T: (604) 290-8100

Rahim Lakha

E. rahim@bluesailcapital.com

Brett Matich

T: (604) 484 1230

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward- looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to the remaining cash payments pursuant to the APA, the achievement of performance milestones of the PSUs and the development of the Florália Hematite Project. There are uncertainties inherent in forward-looking information, including factors beyond the Company’s control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein.

The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s filings with Canadian securities regulators, which filings are available at www.sedarplus.ca.

Back to Past News